Chaos kills coordination

Economic calculation requires more than just monetary stability

This week’s newsletter originally appeared on Truth on the Market, a website full of scholarly commentary on law, economics, and more.

Policy chaos doesn’t just make headlines; it fundamentally disrupts economic calculation and prosperity. Like a stone thrown into still water, chaos ripples through the economy in ways that are hard to see but that can be profoundly destructive to prosperity and growth.

Its effects also ripple outward: freezing investment, distorting prices, and disrupting the calculations upon which markets depend. When businesses and individuals can’t predict the basic rules of the game, economic activity is stalled in ways that compound over time.

Consider the basic economic idea that prices coordinate economic decisions. Prices serve as signals that inform millions of decentralized decisions, but they can only perform this function when market participants trust their information content. When policy creates inflation uncertainty, prices become noisier signals. The social cost isn’t actually the higher prices, but rather how unpredictable prices muddy economic calculation. Investment projects that would create value under stable prices may be abandoned when inflation risk clouds the picture.

But monetary instability is just the clearest example. What really matters is the broader institutional framework that allows economic calculation to happen at all. When policy areas face arbitrary day-by-day reversals, it breaks the web of expectations that make our economic order possible. Research consistently documents how policy uncertainty harms investment.

It’s easy to see why. Imagine a chip manufacturer that wants to build a new plant. That will take at least five years—sometimes much more—and involve billions of dollars. The firm needs to forecast input costs affected by trade policy, labor costs influenced by immigration rules, regulatory-compliance costs, tax rates, and more. When these become highly uncertain, the natural response is to delay investment and hoard cash. Multiply this across millions of decisionmakers and you get a massive dampening effect on economic dynamism.

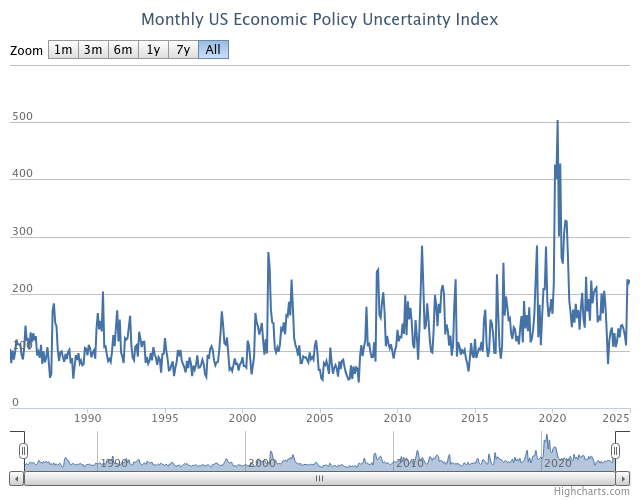

Research by Scott Baker, Nick Bloom, and Steven Davis (along with many follow-up papers) demonstrates that this isn’t just theory. They’ve developed metrics of policy uncertainty that are incorporated into their Economic Policy Uncertainty Index.

Their research quantifies these effects: when policy uncertainty jumped from 2005-2006 levels to 2011-2012 levels, it preceded a 6% decline in business investment, a 1.1% drop in industrial production, and a 0.35% fall in employment. These aren’t just academic estimates: they represent real factories not built, machines not purchased, and jobs not created. When policy becomes as unpredictable as it did during the financial crisis, the economic toll is substantial and measurable.

That kind of uncertainty is rapidly on the rise in the United States.

The literature shows that policy instability creates economic drags through multiple channels: investment, production, and employment all suffer. But it’s the investment channel that takes the biggest hit, with the 6% decline suggesting businesses become particularly hesitant to commit capital when policy directions grow murky.

The effects ripple far beyond business investment. Students hesitate to take on debt for higher education when federal loan programs could change arbitrarily. Farmers struggle with planting decisions when agricultural policy and trade relationships are in constant flux. Immigrant entrepreneurs pause before starting businesses when their status feels precarious. Researchers halt long-term projects when grant funding becomes unreliable.

Of course, there are tradeoffs. A completely frozen system would fail to adapt to technological change, emerging risks, or evolving social needs. The goal isn’t to prevent all change, but to ensure changes follow predictable processes that maintain coherent and knowable rules, rather than creating arbitrary chaos.

While there are generally tradeoffs, some policy changes create only downsides—all of the uncertainty costs with none of the benefits of actual reform. When an executive order gets immediately struck down by courts, or when an agency like the Federal Trade Commission (FTC) pushes a policy through rulemaking that gets immediately blocked by the courts, we get all the costs of uncertainty with none of the benefits of actual reform. The initial announcement forces companies to waste resources planning for a change that may never stick, while creating uncertainty that chills both hiring and investment.

This isn’t, of course, about whether a specific policy is good or bad; it’s about the economic waste of unstable interventions that create noise in the system without shifting that system in any knowable direction. Economic prosperity depends less on specific policies and more on preserving basic institutional stability. A suboptimal but predictable rule is often better than an optimal but unstable one.

None of this means policy should never change. Evolution is necessary and healthy. But changes should follow established processes and maintain coherent and knowable rules, rather than creating arbitrary chaos. The goal should be to maintain a constitutional order that enables economic calculation.

The costs of institutional instability are largely invisible, but they can be profound: lost investments, foregone innovations, and gradual erosion of the intricate coordination that enables prosperity. We should judge political movements not just on their policy goals but on whether they maintain the stable framework that makes economic calculation possible.

Economic prosperity doesn’t require perfect policies, but it does require stable ones. A predictable, rule-based framework is what allows businesses to invest, workers to plan, and markets to function. Without it, we get paralysis, waste, and stagnation.

Stability remains underrated

Unrelenting uncertainty produces a certain stability of its own: stasis and decay.