Is Inflation Demand or Supply Driven?

Basic economics says both 😱

You’re reading Economic Forces, a free weekly newsletter on economics, especially price theory, without the politics. You can support our newsletter by signing up here:

You could say it’s been a big week in U.S. economics headlines. The May CPI inflation number increased to 8.6%, the highest number since 1981. Yesterday, the Fed raised interest rates by 0.75%, the largest increase since 1994.

In the whole debate surrounding inflation, two camps have emerged. Some people think our current inflation is a supply-side story. Covid restrictions, supply-chain bottlenecks, Russia’s invasion of Ukraine, and 1,000 other small headlines combined reduce supply and drive up prices. On the other side, the demand-side story points to stimulus checks, low interest rates, and generous monetary policy that all increase spending and drive up prices. Since it is a supply and demand story, it’s no surprise that Josh and I have weighed in on inflation a few times.

In this week’s newsletter, I will finally give the definitive answer to whether supply or demand is causing inflation. After everyone has read this, I expect the debate to be settled.

Before getting to the answer, we will do a little price theory lesson on how we can differentiate supply vs. demand shocks. After we get some graphs under our belt, we will be ready for the answer: inflation has been caused by both supply and demand shocks.

You’re welcome. Don’t forget to smash that subscribe button.

Warning: there will be no algebra, but there will be graphs. Lots of graphs. It’s hopefully good for an undergraduate course. Back in the day, bloggers may have called this “wonky,” but that seems cringe in 2022.

Identifying Supply and Demand Shocks

We start with the classic problem of the identification of supply and demand. Since price and quantity are determined by supply and demand, we can’t say in general whether a change in supply or demand caused prices and quantities to change in response. Empirical economists now go off searching for some way to say for certain this is a supply change.

And if you have a good way of teasing out supply movements from demand movements, that’s great! The fact that OPEC raised oil prices can tell you something about the demand for oil (and the supply by non-OPEC countries as well).

The identification probably is why Scott Sumner always says, “never reason from a price change.” If we see a price rise, it could be because supply changed in a negative way or demand changed in a positive way. We simply cannot look at prices and have the answer.

That’s true as far as it goes. Many economists may even have a knee-jerk reaction that we cannot say anything without an instrument. But even without a clean instrument, supply and demand can tell us a lot!

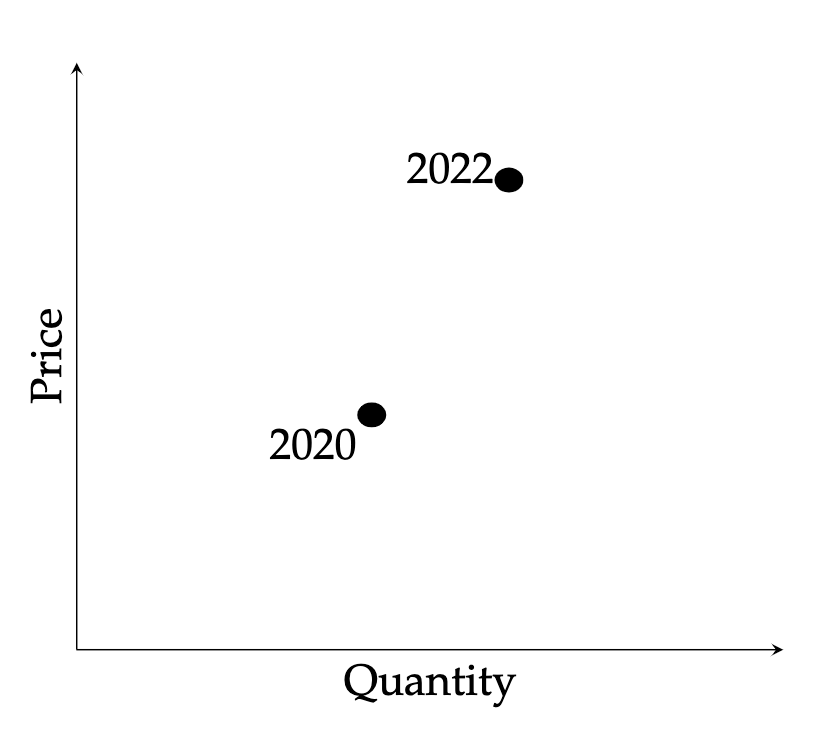

I don’t know about you, but I put price and quantity on the axes when I draw supply and demand. And if we know something about price and quantity, we can say a bit about what caused it. Imagine we observe price and quantity for two different years. We don’t see the curves; we just see the equilibrium price and quantity.

We can immediately rule out a few things. We know what the story isn’t. In the case above, the observed data cannot be 100% supply-driven. With supply shocks, price and quantity move in opposite directions: price goes up when quantity decreases or the price goes down when the quantity increases. Demand needs to be part of (if not the whole) story.

Let’s imagine we can reconstruct the curves behind the data points.

But that’s not saying a whole lot. We certainly can’t then conclude that supply didn't change. Supply could have shifted left or right, as long as demand shifted in the right way.

But we can say which shift was bigger, which is nice.

Let’s assume price and quantity are measured on a log scale (so we can think of everything in percentage terms) and that demand and supply are linear on that scale. Then we can measure supply and demand shifts as a percentage move to left or right. The figure below is a demand shift to the right of some amount, say 20%.

If we plug our supply curve back in there, we see that the demand shift is greater than the increase in quantity.

In the case above, when the price (which we observe) increased, we know that the quantity increase (which also observe) was less than the demand shift (which we don’t observe). Some of that demand gets cut off by the increase in price. Using similar logic, we can see that the quantity change is greater than the supply shift as well.

If price increases, demand shift > quantity change > supply shift.

If price decreases, demand shift < quantity change < supply shift.

And that makes intuitive sense. If price increases, demand must have been more powerful, overcoming any positive increase in supply. If price decreases, supply must have been more powerful.

Notice that we have no instruments. This is all from the assumption that supply slopes up. In jargon that my microeconomic friends will appreciate, supply and demand are partially identified by the slope restrictions.

Quantity Changes Reflect the Average of the Two Shifts; Price Changes Reflect the Difference of the Two Shifts

We can say more than just that ordering if we know something about elasticities, but I promised no algebra. As always, I’ll send you to Kevin Murphy for the more complicated algebra. I can illustrate the basic idea using extreme examples and the intuition above.

Let’s first imagine that we know the shifts (again, that’s the fundamental problem, so it is cheating, but it’s helpful to imagine we do). I will show that the overall change in quantity is basically the average of the supply and demand forces.

Suppose there is a positive demand shock (say +8%, so the whole curve moves eight units to the right) and a negative supply shock (say -8%, so the whole curve moves eight units to the left). We know for sure that the price must go up since both forces push the price up.

We’ve also learned that when the price increases, we can order things: demand shift > quantity change > supply shift. That’s a solid prediction for a theorist like myself. Quantity will either increase 8%, decrease 8%, or do something in between.

Let’s draw this out. Assume that supply and demand have the same elasticities, which means the same slope. With these strong assumptions, we can determine exactly where the new equilibrium will be after the demand and supply shocks; we will have zero change in quantity.

The more general idea is that the change in quantity equals an average of the two shifts. The average of 8 and -8 is zero. If we don’t assume equal elasticities it gets more complicated and we need to talk about weighted averages. Again go to the Murphy video above.

How much will the price increase from these two shocks? Let’s add one more assumption so that we can further avoid any real math. Let’s assume demand has an elasticity of -1 and supply has an elasticity of +1 (which I’ve already drawn in the figure above). The observed price tells us about the difference in the two shocks (8% - (-8%) divided by 2 in this case)= 8%.

How much of the price and quantity change can we attribute to each shift? We finally have all the tools to do a decomposition of the overall change. If we just saw only a demand shift, the price would only rise half as much as we actually observe, 4% instead of 8%. Same thing for a supply shift: the price would only rise half as much as we actually observed. I think it is reasonable to conclude that the observed price increase was caused half by demand and half by supply.

Applying Supply and Demand to the 2021-2022 Inflation

With the serious micro out of the way, let’s do some macro.

Warning: this is not a serious macroeconomic analysis. This is like what you’d read in the New York Times and simply for teaching purposes. Jerome Powell, if you’re reading this, please consult your 1,000 economists for actual help.

Let’s apply the framework above to the past two years through the aggregate demand and aggregate supply model. (Feel free to tell me in the comments how dumb the AS-AD model is. I’m running with it.)

Hey, look! We already have the years 2020 and 2022 on the graph. What are the chances? Lucky me.

The first complication is that in macro, especially in business cycle analysis, we aren’t imagining the economy being constant if weren’t for those pesky shocks. The economy is growing over time and so we also need to be careful that we are thinking of all shocks as relative to the trend growth of prices and quantities. So I will think of the point on the graph as a price and quantity above or below the trend line.

The second complication is that anytime we are doing AS-AD and we actually want to go to the data, we need to be clear about which bundle of goods we are talking about. Instead of starting out with all the goods in GDP, I will use the personal consumption expenditure (PCE) basket, since that’s the price index that the Fed is targeting. The GDP data is left as an exercise for the reader.

So what happened to the quantity of PCE? Just eyeballing a trend line (again, not serious analysis), the quantity dropped in 2020 but returned to trend in early 2021, and has remained on trend. When we plot this on the AS-AD model, the quantity did not change.

What happened to the price of this basket? This is the PCE index, often just called PCE. It fell a little, returned to trend in early 2021, and rose above trend since. It’s now about 8% higher than the trend. When we plot this on the AS-AD model, the price increased by about 8 units.

Together, we have:

We now have a definitive answer to the question is inflation because of demand or supply—the correct answer: both. You’re welcome.

We know from the model that AD must be shifted to the right relative to trend. It is not just about returning demand to trend; it must have overshot at this point. If the story were 100% a supply shock, the quantity would not have returned to trend for the past year. The same is true for demand. The whole story cannot be demand, otherwise, quantity would be above trend.

If we’re willing to take a further stance on the relative size of the two elasticities, we can say more. For example, if we say that the elasticities are about the same, then we can say about half of the inflation is caused by demand and half is caused by supply. We can blame 4% of the 8% inflation on supply and 4% on demand. That seems like a fair starting point.

If we think supply is more elastic (in the short run at least), then demand curve shifting doesn’t do much to the price level, and the supply shift must be the dominant force when we see the price rising. Here’s where the actual macroeconomists can help to put numbers on these elasticities.

How do we think about the Fed’s policy response in light of this? My opinion, and it is only an opinion, is that the Fed should not respond to supply shocks if it knows they are supply shocks. Big if. The rising price reflects the real cost of resources, and prices should rise. Relative to that baseline, the Fed has overshot. Some of the inflation is from over-stimulating demand. And everyone serious, including Chair Powell, admits as much.

None of this tells us about what policy should be in the future. The entire analysis is about the past. What matters for current policy is expectations of future inflation, and that’s a whole other issue that we will leave for now.

Dear Brian, thank you for this great post ! I think there is a minor typo in the 2nd graph, maybe the second demand curve should be "D, 2022".

Great post. I'd love to see this with the PCE vs PCE price index plotted as a trajectory on a log-log plot, rather than just the two points. I think the dynamics could be quite interesting.