There Is No Such Thing As Supply, Wall Street and Housing Edition

Is Wall Street driving up home prices?

At a high level, supply and demand is stupidly simple. In practice, it is often difficult to apply in a particular case. Housing is one case where I’ve seen a lot of confusion lately.

I’m traveling this week, so time is a little tight. I decided to save new ideas and remind people of a newsletter from a few years ago on total demand. At the bottom, I use total demand to think about whether institutional investors or “Wall Street” are driving up housing prices.

In how many posts have we talked about supply and demand? More than one?

There’s one minor problem: There’s no such thing as supply. It’s demand all the way down.

When we usually talk about demand, we mean consumer demand. There are people out in the world that do not currently possess the good but would buy the good at some price.

This is in contrast to producers who currently have the good and are willing to sell for some price. But what about any price below their reservation price? Then they want to keep their own good instead of selling it, aka they demand the good.

Let’s call this combination of demand total demand; it is the demand from both people who currently possess the good and those that do not currently possess the good.

Producer demand?

The difference between total demand and total consumer demand is the producer demand. Producer demand seems like a contradiction but we can see it from a simple point: Producers do not sell at just any price. They are implicitly demanding their own good.

For example, I cannot go to the BMW dealership and offer $1 for the new i8 and get it. Yet, no other consumer is there right now. It seems I am the highest demander there. Why not sell it to me?

While I’m not currently bidding against any other consumer, I am bidding against the current owner, which is the dealership. As is usually the case with firms, it is not that the dealership directly values the car in the same way that I do. Instead, they have a derived demand for holding the car, which is derived from the expectation of selling the car in the future. This is similar to how firms have a derived demand for workers, which is derived from the expectation of selling the products of the workers in the future.

Because the producers demand the car and their demand is above mine, they “receive” the good. By forgoing the dollar that I offer them, they are effectively buying the car for $1. If they did not demand the i8, they would sell it for any price and it was up to customers to bid it up from $0.

This concept can be illustrated using a graph similar to the standard supply and demand. Here total demand is TD. It consists of consumer demand (D) and supplier demand (which is a reverse of supply, S). The equilibrium price is where the total demand (TD) equals the total supply (stock), not just the standard supply. This supply is the amount that actually would exchange hands at a certain price. The TD/stock equilibrium price will be the same as the intersection of traditional D and S.

This is a now-forgotten tool that I first discovered in Man, Economy, and State, as shown below.

One possible downside of the TD/stock graph is that it does not show how much of the good actually exchanges hands, usually labeled Q*. The TD/stock graph looks the same if all the original holders of a good sell them or if none do.

But why does the number of goods that actually exchange hands matter? One counter-intuitive point is that it does not really matter. The number of transactions really doesn’t matter.

We can see this in Alchian and Allen’s explanation of the same idea. (HT to Sergio Martinez for reminding me that it’s in A&A. I have a habit of forgetting what is in A&A vs. what are my own, creative thoughts.)

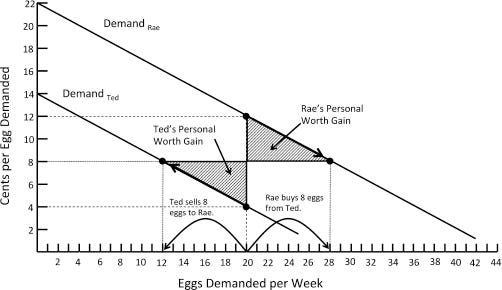

Consider a world where Rae and Ted have a demand for eggs and each starts with 20 eggs. However, Rae values eggs more than Ted and so they trade until there marginal value is equalized. Alchian and Allen’s figure is below.

Here it becomes clear that what we call “supply” is an artificial construct that is just a by-product of the initial allocation of eggs. As David Glasner points out, this is just a version of Stigler’s Coase theorem. In a world without transaction costs, the final allocation doesn’t depend on the initial allocation of property rights. If initial property rights don’t matter, the market is completely determined by the relative demand. Supply doesn’t add anything. Quantity traded doesn’t matter for welfare.

Economics as a toolbox

At a conceptual level, I like this approach because it helps us avoid the Marshallian fallacy that there is a subjective side (consumers) and an objective side (producers) of the economy. It’s all just demand; it’s all subjective. When we think of producers demanding their own goods, we avoid this false dichotomy. It also may help us all avoid silly things like assuming that supply curves are horizontal in the long run. There is no reason to assume that, just as there is no reason to assume demand curves are horizontal.

At a less abstract level, TD/stock curves are another example of how clear economic thinking can improve our understanding and help us avoid a few mistakes.

First, suppose only a few shares of a company trade in any day. People may claim that this does not reflect the “true” market price since the price would drop if many stocks came on the market. However, this drop would only happen if the current holders lower their demand to hold stocks. They will try to sell the stocks if the current market price is above their group evaluation of the “true” price. Instead, everyone who is holding the cash values it above the market price. An equilibrium price always reflects the price where total demand equals the stock. It is impossible for it not to.

Second, imagine there is an economic good, say money, which has a low quantity traded in any time period. Some would be tempted to say that this money is idle or not “flowing” in some sense. However, this does not show that the goods are idle or not serving their most valuable purpose. All goods are always possessed by someone. At any point, they are never “flowing.” In the case of money, a low quantity traded only shows that the most valuable use of the money is in cash-balances in some period.

The question is not whether the money is idle since it is obviously serving its most valuable purpose at the moment. Whether its most valued use is to those who had it last period or not is irrelevant. They are both the same thing.

The fact that trade is small is not important. Instead, if worried, we should be asking why are banks holding money? What is the uncertainty that makes cash balances the most desirable use of the money? Is it some distortion of incentives? Or is the world just naturally uncertain and banks want to hold money?

Is Wall Street driving up housing prices?

Okay. Now onto some new stuff.

Here's the argument you often hear: big bad institutional investors on Wall Street are swooping into housing markets, buying up all the properties, and driving up prices for everyone else. They're the reason why regular folks can't afford to buy a home anymore, and they're the ones we should blame for the housing affordability crisis.

First, there is a quantitative question. How common is this and is it plausible to have a major effect? After all, the US economy is huge. But this is a theory post. What does this theory suggest?

Second, we must ask, why would investors enter the housing market? Are they the cause, or are their actions simply a reaction to or an effect of something else? This cause vs. effect can be quite confusing in discussions of housing. For example, does density cause home prices to rise?

Let us assume Wall Street is the cause. People woke up one day and realized they could buy housing. What would be the effect on house prices?

Here, the total demand model is especially helpful. For one thing, housing is a durable good. Unlike a hamburger or a haircut, a house doesn't disappear after you consume it. It sticks around for decades (or even centuries), which means that the existing stock of homes plays a much bigger role in determining prices and affordability than in markets for non-durable goods. In the short term, the stock is fixed and transactions are all about who demands it more: current occupants or others.

When you look at it through the lens of total demand and stock, this argument about Wall Street seems implausible. Remember, the total demand for housing is the sum of all the individual demands from both potential buyers and current owners. It's what ultimately determines prices in the market, given the existing stock of homes.

When we talk about the demand for housing, we're usually referring to the demand for "housing services"—that is, the bundle of shelter, comfort, and amenities that come with living in a particular home.

But institutional investors? Investors are not part of that total demand equation, at least not directly, for housing services. They don't want to live in the properties they buy; they want to profit from them. In economic terms, they're demanding a different product altogether: the future stream of rental income and potential price appreciation that comes with owning a piece of real estate.

Instead, what institutional investors are really doing is supplying capital to the housing market. They're buying properties, sure, but then they're turning around and renting them out to tenants. In effect, they're acting as a conduit between the rental market and the owner-occupied market, buying homes from one group and supplying them to another.

Now, in a frictionless world, this buying and renting activity may net out to zero in terms of its impact on total housing demand. Every home that an investor buys and rents out is one less home available for a traditional buyer, but it's also one more rental unit added to the market. The reduction in owner-occupied demand is offset by the increase in rental supply, leaving total demand unchanged. Sure, investors can change the ownership/rental ratio but it is unlikely to systematically drive up prices.

The world is rarely so neat and tidy. In practice, there are all sorts of frictions and imperfections that can cause investor activity to have a non-zero impact on housing prices and affordability. But the model suggests the net effect of Wall Street waking up and discovering it can invest in housing is unlikely to really drive the market price for housing services up or down.

I think the actual implicit argument people are often making when they criticize Wall Street involvement in the housing market is that they prefer owner-occupied to rental housing (believe that owner occupied housing has more positive social externalities than renting, offers fewer opportunities for exploiting the buyer of housing services, whatever) and hypothesize that Wall Street involvement drives up the price of purchasing a home in an absolute sense.

Wouldn’t in this model, a rapidly increasing population drive up house prices.