We Are Measuring Inflation Wrong

This is about price theory, not a conspiracy

You are reading Economic Forces, a free weekly newsletter on economics, especially price theory, without the politics. Economic Forces arrives weekly in the inboxes of over 12,000 subscribers. You can support our newsletter by sharing this free post or becoming a paid subscriber:

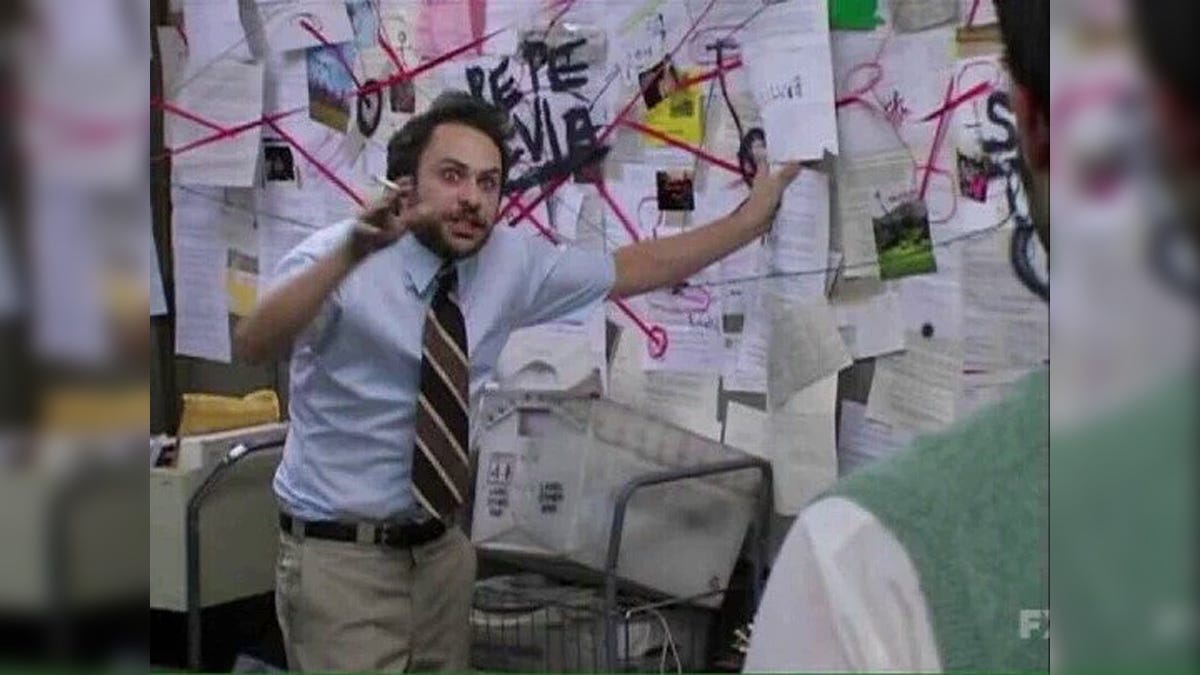

For almost my entire life, the measured rate of inflation has been low. During this time, I have heard many non-economists argue that the measured inflation rate is artificially low. The argument is typically driven by claims that there are important things that are excluded from the index or that certain components are measured incorrectly. Sometimes it is claimed that this is done on purpose by the U.S. government’s bureaucracy to deliberately keep measured inflation low.

This discourse is in sharp contrast to what I often hear from fellow economists. When I listen to economists about inflation, they like to point out that our price indices are often subject to substitution bias and, as a result, tend to overestimate inflation. Naturally, this is not a popular argument with non-economists.

I don’t have much to say about the conspiratorial aspects of the debate, at least in the United States. However, this is mostly based on the fact that I know and have interacted with people who work on this stuff. They tend to be so deep in the weeds on the nerdiest aspects of measurement that it seems hard to square that with a conspiracy. Furthermore, many of the aspects of the conspiratorial argument tend to be things that the people doing the measuring are also really concerned about — things like the difficulty of measuring particular components (e.g., housing) and hedonic price adjustments.

Nonetheless, I think that economists make a big mistake when they dismiss the complaints of the public with regards to the measurement of inflation. There are ways in which we know that our measures of inflation are wrong. The purpose of my post today is to discuss one of those reasons. But to do so, I need to dig into what price theory tells us about the construction of a price index.

Price theory is all about relative prices. Thus, one might wonder what price theory has to say about the price level. In fact, if we think sufficiently abstract, it is possible to think that any price level is consistent with a given equilibrium as long as relative prices are the same in each case. But whereas price theory is concerned with relative prices, monetary economics is concerned with the price level. What determines the price level? How to changes in the money supply and money demand affect the price level? Do such changes also affect relative prices? In order to answer these questions, we need to be able to measure the price level.

In the real world, a lot of things are changing at once. These are all of the ordinary things that we think about in price theory that lead to changes in relative prices. At the same time, the supply and demand for money might be changing as well, which will affect money prices. How can we say whether prices, on average, are going up or going down in that context?

There are two ways that we can think about this. One way is to think about the ideal measure of the price index and one way is to think about the practical way. Let’s start with the ideal way. If we want to measure the price index in an ideal way, what we would want to do is measure the monetary cost of a constant-utility basket of goods. In other words, suppose that from one period to the next a bunch of things change. Those changes are going to result in a different level of expenditures. However, if income and relative prices are changing, so are quantities. Thus, looking at total expenditures is going to be misleading because expenditures includes both price and quantity. Furthermore, different levels of spending might be associated with different levels of utility. You might be paying more or less and getting more or less satisfaction. Thus, this isn’t an apples-to-apples comparison. This is why we want to track changes in the cost of a constant-utility basket of goods. Yes, prices and income might change, but in theory we should be able to find a basket of goods that clears the market and provides the same level of utility.

From that description, one can easily understand why I called that “ideal.” How would one go about finding changes in the cost of a constant-utility basket of goods when utility isn’t really observable?

A practical solution to estimating a price index might be as follows. Consider two-period, two-good example. We observe the price of eggs and the price of milk each period. We also observe the quantity of eggs purchased and the quantity of milk purchased each period. If we want to track changes in prices over time, we could calculate expenditures for period 1 and period 2 using the quantities of eggs and milk purchased in the first period. Alternatively, we could calculate expenditures for period 1 and 2 using the quantities of eggs and milk purchased in the second period. In each case, the first period’s expenditure could be normalized to 100 and the second period price level could be calculated by multiplying 100 by the ratio of expenditures in period 2 to expenditures in period 1. Or, if we want to get really fancy, we could take the geometric average of the ratio of expenditures using both methods and multiply that by 100 to get the price level in the second period.

The purpose of doing any of these three options is that, since you are holding quantities constant across periods, your measures of expenditures are only capturing changes in prices. Effectively, what you are doing is constructing a weighted average of prices in which the weights are fixed quantities of the goods.

But is there any reason to think that this practical exercise is useful given the discussion of the ideal construction of a price index? Actually, yes!

In price theory, students are typically taught how to find demand curves by solving utility maximization problems. In other words, students are asked to solve a problem of a consumer who wants to maximize utility subject to a budget constraint. This exercise yields optimal conditions that can be combined to get demand curves for each good. These demand curves show that the quantity demanded of a good is a function of relative prices and income. These demand curves are Marshallian demand curves.

An alternative way to think about the consumer’s choice is to think about minimizing the consumer’s level of expenditures for a given amount of utility. Solving this optimization problem yields what are called Hicksian demand curves. The crucial thing about Hicksian demand curves is that they express the quantity demanded as a function of relative prices and the level of utility. Furthermore, one can derive an expenditure function by calculating the product of price and the Hicksian quantity demanded for each good and then adding up the expenditures on each good. By definition, this expenditure function measures total expenditures for a given level of utility. Changes in the expenditure function over time are therefore exactly what we want to measure when we try to measure the price level!

The reason that this is important is that we can compare this insight from price theory with the practical calculations of a price index to determine whether these practical measures can approximate what our theory says is ideal. Let’s go back to the two-good, two-period example. Suppose that the only thing that changes from period 1 to period 2 is the price of milk. Suppose the price of milk goes up by $1. By how much would the price index change? The answer is simple: the fixed quantity of milk used in the construction of the index. To a first approximation, this is what the expenditure function says. Thus, the practical price index that I have described seems like a good first approximation to the ideal measure.

Unfortunately, however, this practical price index does have its limitations. The actual expenditure function derived from price theory is actually a concave function in any single price. In other words, holding everything else constant, as the price of milk goes up, total expenditure will increase at a slower and slower rate. Why? Because demand is downward-sloping. As the price of a particular good rises, the quantity demanded of that good declines. The total increase in expenditures is tempered by the reduction in quantity demanded.

This why economists love to point out that price indices overstate inflation. What they mean is that these fixed-quantity indices do not capture the substitution effect as people spend less on a particular good as its relative price rises. (I’ll return to this point later.)

Okay, so that is all well and good, but I started this post by saying that we measure inflation wrong. Was that just a bait and switch to get you to read about price theory? No. In fact, now that you are armed with this knowledge, we can dig a little deeper into theory to determine what is missing.

In going back and forth between the theory that underlies price level construction and the practical construction of a price index, I was ignoring something critical in the practical construction. In the two-period, two-good example, I argued that you could use the price of milk and the price of eggs to construct the index. However, recall that price theory tells us that Hicksian demand is a function of relative prices and the level of utility. In a two-good, one-period model, one can think of the price of eggs in terms of milk or the price of milk in terms of eggs. Obviously, one is just the reciprocal of the other. This is the exhaustive list of relative prices in a one-period model. However, in a two-period model, we can think of the price of milk today in terms of the price of eggs today or we could think about the price of milk today in terms of the price of milk tomorrow. The relative price of consumption today is often referred to as the real interest rate. Thus, if we are going to argue that our measure of the price index is going to approximate the expenditure function, it would need to somehow incorporate changes in the real interest rate.

This point was made by Armen Alchian and Ben Klein. They argued that this insight meant that any price index that claimed to be approximating the ideal index of theory should include asset prices because such prices capture the differences in the value of service flows over time. By excluding asset prices, the constructed price index only captures the relative price of different service flows within a given period of time.

Alternatively, one way to think about this would be to say that in a static model, income is equal to expenditures. Thus, the ideal price index is designed to fluctuate in conjunction with the income level required to purchase a constant-utility basket of goods. In a dynamic model, the present discounted value of income (wealth) is equal to the present discounted value of expenditures. Thus, the ideal price index is designed to fluctuate in conjunction with the level of wealth necessary to purchase a constant-utility bundle of goods. (This is where the idea of a price index as a “cost-of-living” index comes from.)

In short, by excluding asset prices from our estimates of the price level, our price indices are wrong. The price index is missing important variables. Of course, this is easier said than done. As Alchian and Klein admit, in the absence of complete markets some measures of future prices are simply unavailable. Furthermore, one would not only need prices of the assets, but also quantities. Accurate measurement might be prohibitively costly.

Nonetheless, as they point out, this insight is potentially important for policy. Asset prices tend to respond more quickly to changes in the stance of monetary policy than changes in the price of goods. As a result, changes in the price index might not quickly and accurately reflect the change in the stance of monetary policy because asset prices are excluded. Central banks who target the price level (or inflation) might be misled by their measure of the price level to think policy is either too loose or too tight. It is also possible that by stabilizing an incomplete price index, this might cause relative price distortions that have significant consequences in terms of macroeconomic outcomes or allocation efficiency.

At this point, it might also be useful to return to the point that economists make about substitution bias. It is important to note that substitution bias means that inflation is over-estimated relative to the “true” rate of inflation if that measure of the price level is the correct measure. Put differently, if your measure of the price level systematically underestimates the “true” rate of inflation, then the substitution bias is actually pushing that measure in the correct direction — if, by correct, we mean accurate and “true.”

Overall, I view the insight of Alchian and Klein as a reason for some humility. When the general public is concerned about inflation and it isn’t showing up in the price indices, perhaps we should look to measures of asset prices that we do have. It sure beats being dismissive of these arguments. After all, none of these indices are close to perfect for what we really want to measure.