The latest data on business dynamism is very good

The Census data is giving us more reason for optimism

Business dynamism—the process by which firms are born, grow, shrink, and die, and with workers moving between those firms—plays a crucial role in driving productivity growth and job creation in the economy. A competitive economy allows resources to flow to their most productive uses as new ideas and technologies emerge. When dynamism declines, it can lead to reduced competition, lower productivity growth, and less economic vitality overall.

For these reasons, economists have been concerned about the long-term decline in various measures of US business dynamism observed since the 1980s. Fewer new businesses were being started each year, job reallocation rates were falling, and young firms were making up a smaller share of economic activity.

I recently wrote about my optimism for the US going forward and one major reason was the data on dynamism. The COVID-19 pandemic appears to have sparked a dramatic reversal in these trends. Recent work by Ryan Decker and John Haltiwanger provides compelling evidence of a surge in business formation and entrepreneurship since 2020 that has persisted even as the acute phase of the pandemic has passed.

A Data-Driven Case for Productivity Optimism

Noah Smith of Noahpinion generously offered to send this week’s newsletter to his subscribers. Make sure to check out the rest of his writing and subscribe.

One worry is that some of that most optimistic data wouldn’t turn into actual business formation. We just received the most recent data for 2022 and can safely say that is not true. There has been a genuine real increase in dynamism. How much it will continue remains to be seen, but the data we have so far looks good.

Decker and Haltiwanger just released another note on this recent data. Today’s newsletter will explore what they find.

The surge in new business formation

Figure 1 provides an overview of several key measures of business entry, each indexed to early 2019 levels. The most striking series is new business applications, which tracks applications for employer identification numbers (EINs) that are likely to turn into employer businesses. After an initial drop at the onset of the pandemic, applications surged to all-time highs in the summer of 2020 and have remained elevated ever since, though with some cooling in recent months.

While these applications tracked business formation pre-pandemic, maybe something changed. Did the pandemic just cause people to panic and think they needed a new job? Did everyone dream of becoming a TikToker while stuck at home?

We can now safely say that this surge in applications translated into actual new employer businesses. Both the Business Employment Dynamics (BED) data from the Bureau of Labor Statistics and the Business Dynamics Statistics (BDS) from the Census Bureau show large increases in employer firm births in 2021 and 2022.

The BDS data are particularly significant, as they use a comprehensive firm definition based on ownership and operational control. This is the data we were waiting on. This is the gold standard data. The jump in BDS firm births in 2022 provides definitive evidence that the pandemic entry surge represents genuine entrepreneurial activity, not just changes in legal structures of existing businesses.

The scale of the increase is substantial. BDS data show that firm births in the year through March 2022 reached levels not seen since before the Great Recession. This represents a striking reversal of the long-term decline in startup rates observed over recent decades.

Job creation from new firms

Not only did the number of new firms increase, but these new firms also created a substantial number of jobs. Figure 2 shows both the number of new firm births and the associated job creation from the BDS and BED data. Both sources show jumps in 2022, though the increase in jobs is not as dramatic as the increase in firm numbers. This reflects a decline in the average size of new firms during the pandemic, a trend that appears to be reversing in the most recent data.

While the firms have a smaller average size, the sheer number of new firms means that job creation from new firm births has increased. The BDS data show that new firms created about 5.8 million jobs in 2022, up from about 5 million in 2019. This job creation from new firms is a critical source of net job growth in the economy.

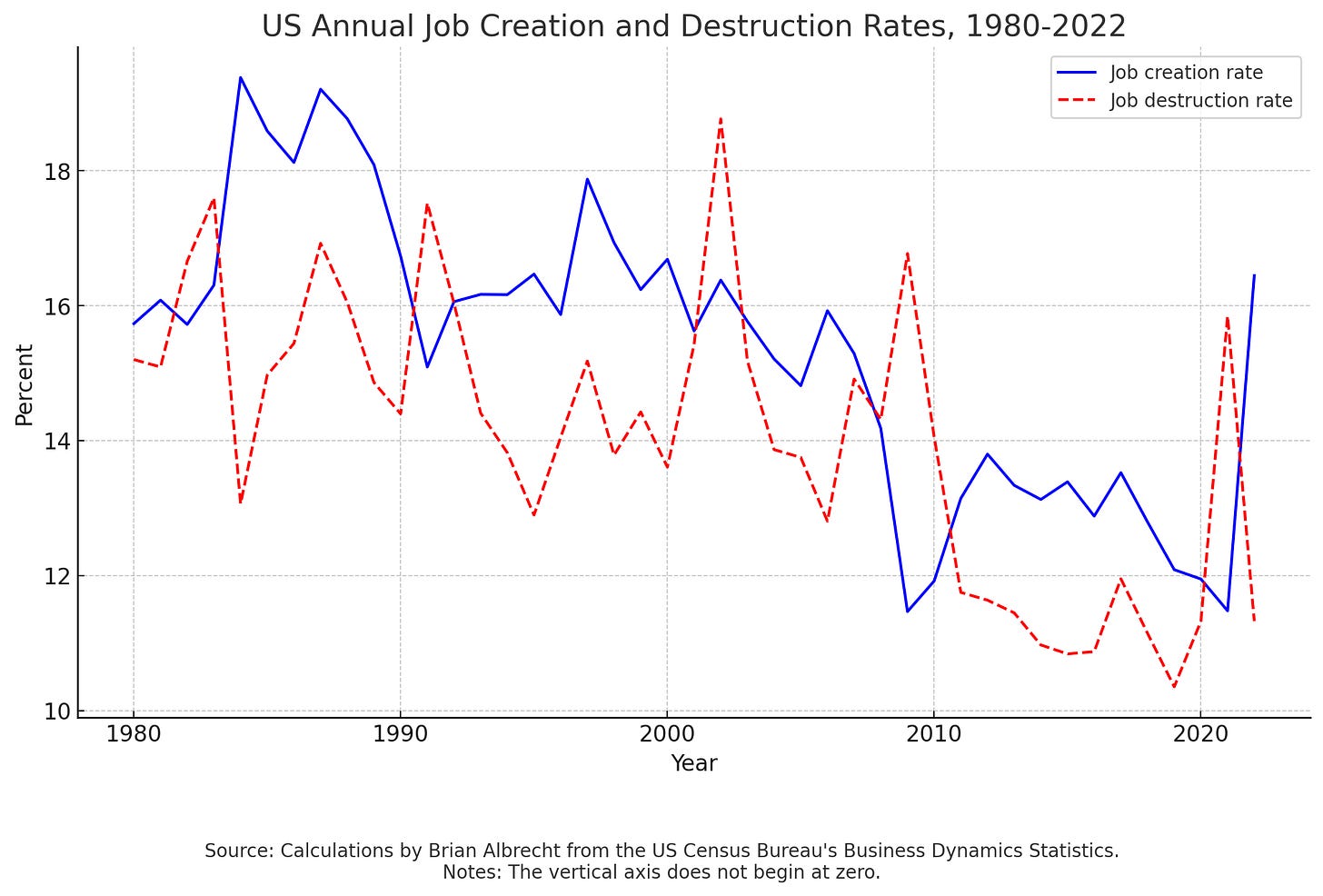

If we look at job creation and destruction as rates over overall jobs, we see the real extent of the surge. 2022 saw a job creation rate above 16%. This is in line with the booming 90s although below the peak of the 80s. If this remains even remotely true for the next handful of years, that will be huge for the economy going forward.

Sector and geographic patterns

The business formation surge wasn’t spread evenly across the economy. Decker and Haltiwanger found some sectors and regions saw much bigger increases than others. No surprise, industries that fit well with pandemic life saw the biggest jumps. E-commerce and delivery services boomed, obviously. One surprising fact is that transportation and warehousing firms not only increased in number, but the new entrants were bigger on average too.

More importantly for long-run growth, high-tech sectors have seen an especially strong and persistent surge in new businesses. This isn’t just a blip—it's lasted well beyond the acute phase of the pandemic. If that sticks, we could be looking at a nice boost to productivity growth down the line.Again, there’s reason for optimism.

Geographically, the surge in business applications was strongest in southern states and areas outside of city centers, consistent with broader pandemic-era economic and demographic shifts. The authors also find a close correlation between local business formation and measures of worker quits, suggesting a link between the "Great Resignation" and increased entrepreneurship.

The US isn’t alone

.The surge in business dynamism observed in the US is not an isolated phenomenon, as evidenced by similar trends in the UK. Both countries show a notable uptick in job creation rates in recent years, with the UK’s not being as dramatic but a good sign nonetheless.

I should note that I am not as well-versed in UK data and whether the ONS’s statistics are on par with those of the US Census. But what we have looks good for 2022. Combine this with some good policy moves, and the UK may not be stuck forever.

The outlook ahead

So what's next for this business dynamism surge? Well, it's been a pretty nice silver lining to an otherwise rough economic patch. If it keeps up, we might actually reverse that long-term decline in startups we've been worrying about for years. Heck, we might even see a nice bump in productivity growth. Wouldn't that be something?

Yes, the most recent data show some cooling in the pace of new business formation, though it remains elevated compared to pre-pandemic levels. The paper shows that even though applications for likely employer businesses have dropped from their peak, they’re still above pre-pandemic. Based on the characteristics of these applications, we should still see a solid stream of new employer firms popping up over the next couple years.

Bottom line: this surge since 2020 is a big deal. It's a major uptick in economic dynamism that nobody saw coming. Yeah, it's cooling a bit, but we're still way above where we were before the pandemic, especially in tech. This entrepreneurship wave could reshape the whole economic landscape: more innovation, more jobs, better productivity. You can bet policymakers and economists will be watching this like hawks. It's going to be fascinating to see how it all shakes out.